YouTube

The Krypto King

My Name is Tyrelle over 5 years I dropped out of uni in Leeds (Uk) used my business profits from e-commerce, social media marketing and coaching to invest into 40+ Private Crypto Investments, two unicorn companies (Billion dollar companies in 5 years) and become the managing partner of Interstellar Ventures with over $20 Million AUM. I documented my journey along the way, and i'm here to give you the honest reality of investing. Im still learning, I got lucky, and i'm not special you don't need to be to have success, you just have to get started. I hope this channel inspires you to get started too. Disclaimer: Subscribing to my channel provides educational, motivational and inspirational content ONLY. but it does not guarantee financial gains or serve as financial advice. Always do your own research and consult with professionals before making investment decisions. By watching this channel you agree with this disclaimer. Its important to take FULL Context into account.

Put simply you don't have to… This is a tutorial, I'm not selling you a pitch or telling you have to buy my coins.

I'm giving you the tools and information to go and have your own success, and I will tell you what I am up to in the cryptocurrency market.

Join the FREE telegram group for any help and to stay up-to date with the crypto markets.

P.S: This is how I do things… you may do things differently and that's OKAY!

Telegram

The Krypto King

Your guide to the crypto markets I show you how to make money online and invest the profits

» HOW TO EXCHANGE MY MONEY FOR CRYPTO: My bank accounts where temperamental, exchanges would cut down, I was unsure about KYC…

» HOW TO BUY ALT COINS: I would watch videos about multiple coins but I would never know how invest in them

» RESEARCHING ALT COINS: It would take me forever and I would struggle to have true conviction and understanding of what I was buying

» WHEN TO BUY AND WHEN TO TAKE PROFITS: I would ask in Telegram groups for other people's opinions and I would feel nervous when charts would dip

» DECENTRALISED EXCHANGES: I didn't know what one was: I have questions like, what if my transactions got stuck and how did I know if my money was safe and how to avoid scams

You might have had or you may go through a similar experience.

YouTube it takes forever to learn with - there are SO many videos and SO many people to chose from. Who can you trust?

TODAY, I'M GOING TO ANSWER ALL OF YOUR CRYPTO RELATED QUESTIONS AND MORE!

By the end of this video you will know everything you need to know, save this video to your playlists, so you can come to this video any time yo get stuck on any part of crypto.

Disclaimer:

You learn by taking action— Tyrelle Anderson-Brown

Benefits:

Downfalls:

Tutorial later in this course

Benefits:

Downfall:

Tutorial later in this course

But DEX offer a very good opportunity get into projects and experience crypto.

Risks are very high either way.

- Choosing an Exchange:

- Research and select a reputable centralized exchange (like Coinbase, Binance, or Kraken).

- Consider factors like security, fees, available cryptocurrencies, and user interface.

BEST EXCHANGES

TIP: Not every coin is on each exchange, I personally sign up to all exchanges as it means I always have fast access to investing into coins.

For example: UPO and NAKA both have done more than a 10x… THIS YEAR. They were on KuCoin but not Coinbase or Binance.

STEP 1

Get a VPN and buy the pro version - Don't be tight

If you want to be a millionaire you must make sure your investments are safe

Click here for 65% off the BEST VPN for crypto: NordVPN Discount

Join each exchange and KYC; i use BYBIT / BITFLEX for daily trading and the others for spot - Takes 20 mins just do it and get it out the way.

For UK based traders i have attached the best one that i know at the moment below

» Bitflex - Up to $38,000 in bonuses

» Coinbase - 1st most trusted exchange

» Binance - 2nd most trusted exchange

» Bitget - Very low fees

» BYBIT - New coins & $30,000 in bonuses

» KUCOIN - New coins & $10,000 bonuses

» phemex - Best for UK - $5,000 bonuses

Bonus: MetaMask wallet.. yes within MetaMask you can buy crypto with Applepay

Remember: Join all of these exchanges, you might only deposit into one at first but in the future you'll need them to access tokens that may not be on them - You simply deposit the crypto you brought from one exchange to the other - If any exchange isn't available in your area just move to the next.

Creating an Account:

- Visit the chosen exchange's website and sign up.

- Provide necessary personal details as required.

- Verifying Your Account (KYC Process):

- Complete the Know Your Customer (KYC) process, which may require uploading identification documents.

- This step is crucial for compliance and security reasons.

FAQ: Do I need to KYC and why?

Yes, you need to KYC for most crypto exchanges, especially in the U.K. and America. This helps to reduce the amount of scammers but also means your trading is likely going to be taxed. We'll discuss more about how to keep up to date with tax for your country's exchange soon, so stay TUNED.

- Securing Your Account:

- Set up two-factor authentication (2FA) for added security.

- Use a strong, unique password and consider using a password manager.

- Depositing Funds:

- Choose a deposit method (bank transfer, credit card, etc.).

- Follow the instructions to deposit fiat currency or cryptocurrency into your exchange account.

- Don't be afraid to shop around. Sometimes you bank might be the issue, just as you have to have a few crypto exchanges you may have to get a new bank account thats more crypto friendly

PS. consider having one exchange to buy crypto with from your bank and others you just deposit crypto with

- Navigating the Trading Interface:

- Familiarize yourself with the exchange's trading interface.

- Understand the difference between market orders, limit orders, and other trading options.

- Buying and Selling Cryptocurrencies:

- Select the cryptocurrency pair you want to trade.

- Enter the amount you wish to buy or sell and execute the transaction.

- Withdrawing Funds:

- Navigate to the withdrawal section.

- Choose the withdrawal method and follow the instructions to withdraw your funds or transfer your crypto to a personal wallet.

- Choosing a DEX:

- Select a decentralized exchange like Uniswap, SushiSwap, or PancakeSwap.

- Research its compatibility with different wallets and tokens.

- Connecting Your Wallet:

Step-by-Step Guide to Setting Up MetaMask Below

- Go to MetaMask's Official Website: Visit MetaMask.io

- Choose the Correct Version: Select the MetaMask version suitable for your browser (Chrome, Firefox, Brave, or Edge) or mobile device (iOS or Android).

- Download and Install: Click "Download" and follow the instructions to install the MetaMask extension on your browser or the app on your mobile device.

- Open MetaMask: Click on the MetaMask icon in your browser's extension area or open the app on your mobile device.

- Choose to Create a New Wallet: If you're a new user, select the option to create a new wallet.

- Agree to Terms: You'll be asked to agree to MetaMask's terms and privacy policy.

- Create a Strong Password: Enter a secure and memorable password.

- Confirm Your Password: Re-enter the password to ensure it's correct.

- Reveal Your Secret Recovery Phrase: MetaMask will generate a 12-word secret recovery phrase. Click to reveal it.

- Write Down the Phrase: Write the phrase down on paper in the exact order shown and store it in a safe and secure place. This phrase is critical for wallet recovery and should never be shared or stored digitally where it could be hacked.

- The Importance Of Your Phrase: if you lose your phrase, you will lose all access to your wallet. There is no way around this! Keeping your phrase safe is a priority.

- Verify Your Recovery Phrase: To ensure you've recorded it correctly, MetaMask will ask you to input the secret recovery phrase in the order it was provided.

- Complete the Setup: Once you've correctly entered the phrase, your wallet setup is complete.

- View Your Wallet: You can now see your wallet interface, including your account address (public key).

- Start Using MetaMask: You can use MetaMask to store Ethereum and ERC-20 tokens, interact with decentralized applications (DApps), send and receive tokens, and more.

- Security: Always keep your secret recovery phrase private. If someone gains access to it, they can access your wallet.

- Regular Backups: It's a good idea to keep multiple backups of your secret recovery phrase in different secure locations.

- Browser Safety: Be aware of the extensions and websites you use with MetaMask to avoid phishing attacks.

- Understanding the Interface:

- Familiarize yourself with the DEX's interface, focusing on the swap and liquidity pool features.

- Understand the pricing mechanism, which is often based on liquidity pools rather than order books.

- Trading Cryptocurrencies:

- Select the tokens you want to swap. ( Soon i will explain token research tools and strategy )

- Enter the amount, review the transaction details (like gas fees and slippage tolerance), and confirm the swap.

https://etherscan.io/gastracker#chart_gasprice

- Adding and Removing Liquidity (Advanced geek stuff):

- If interested in providing liquidity, navigate to the liquidity section.

- Choose the token pair, add the specified amount to the liquidity pool, and understand the associated risks and rewards.

- Completing Transactions:

- Confirm all transactions through your connected wallet.

- Be aware of network fees (gas) which can vary significantly.

- Stay Informed: Regularly update yourself on the exchange’s features and security practices.

- Practice Caution: Start with small transactions to become comfortable with the process.

- Security First: Always prioritize the security of your funds and personal information.

Fee Structure Explanation:

- Detail the types of fees users might encounter, such as trading fees, withdrawal fees, and network fees (especially for DEXs).

- Explain how fees can vary based on transaction size, frequency, and chosen payment methods.

For example…

Instead it's this guy…

It's just about getting started… You'll make mistakes, maybe lose money… But you'll learn a lot!

- Market Analysis Tools:

I've also taken the watch list from my crypto portfolio which you can copy here:

https://www.tradingview.com/watchlists/116564231/

Now that you're signed up to trading view, let's get started with how I like to read charts and what indicators I use.

Moving Averages (MA):

- Simple Moving Average (SMA): Calculates the average price of a security over a specific number of days.

- Exponential Moving Average (EMA): Similar to SMA but gives more weight to recent prices, making it more responsive to new information.

- Moving Average Convergence Divergence (MACD):

- Shows the relationship between two moving averages of a security’s price.

- Useful for identifying trend direction, momentum, and potential reversals.

- Relative Strength Index (RSI):

- Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Ranges from 0 to 100; typically, readings above 70 indicate overbought, and below 30 indicate oversold.

- Fibonacci Retracement:

- Uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction.

- These levels are 23.6%, 38.2%, 61.8% and 100% retracement.

- Volume:

- Not a technical indicator in the traditional sense, but it's crucial for confirming trends.

- High volume indicates a high interest in a security at its current price.

- Offers more data points, which provide a more comprehensive look at resistance and support levels.

- Consists of five lines, each giving information about the price action.

- Market Cypher is an amazing tool not just for large market caps - but recently I have found smaller marketcap strategies that work too

- Combine Indicators: Use multiple indicators to confirm trends and signals.

- Understand the Context: Indicators should be used in conjunction with market analysis and other forms of research.

- Customize Settings: Tailor the settings of indicators to fit your trading strategy and time frame.

- Practice: Use a demo account to familiarize yourself with how these indicators work in real-time before applying them in live trading.

Placing your first trade... Let's do it together!

First… We're going to plan our trade.

WARNING - PUT YOUR GROWN MAN HAT ON!

Before we get into this, let's start off by:

Devise a Cut Your Loses Limit:

- Determine a maximum allowable drop in your trading portfolio (drawdown) and adjust your strategy or pause trading if this limit is reached.

TIP: Understand the poker stakes strategy

Read this:

https://www.cardschat.com/poker/strategy/poker-bankroll-management/

Example: I'm going to take $20 trades till my account hits $5,000 but no matter what whatever you put in be prepared to lose it all... Similar to taking your bank card to a casino. Having $50k in your wallet and you work a 9-5 at McDonalds - maybe pull a bit out and use it to increase your active income.

- How I Plan My Trades:

- Set Stop-Loss and Take-Profit Orders: Set predefined level where you will automatically close your position at a profit

- Stop-Loss Orders: Set a predefined price level where your position will automatically close to limit potential losses.

- Take-Profit Orders: Specify a price at which to exit a profitable trade to lock in gains.

- Risk-Reward Ratio:

- Before entering a trade, evaluate the potential reward relative to the risk. Common ratios include 2:1 or 3:1, where the potential profit is double or triple the potential loss.

- Position Sizing:

- Determine the size of each trade based on a percentage of your total trading capital. A common rule is not to risk more than 1-2% of your capital on a single trade.

- Diversification:

- Spread your investments across different assets or markets to reduce exposure to any single risk.

Personally, I loop profits from my trading account, into my longer term holds. Sometimes within platforms like Bybit, I will even use my trading profited spot holdings as collateral of my trades.

Meaning I can use the same amount of ETH I'm holding as USDT for my longs but if I lose, I will lose the ETH so you have to be carful and prepared. That's why I don't use my longer term holdings of ETH.

» Business Cash Holdings: Payroll etc.

» Trading Account + Sub Accounts: Never have a lot of money in your trading... you will trade with it

» Long Term Holdings: Cold/hot wallets

» Altcoin Holdings: Split between different narratives and Market caps - D.W I explain this later in the course

» Private Sales: Long term very early start up investments… Yes, also covered later in the course

» Equity Deals & Buying Other Businesses

TIP: When I got started it was just my business money and a trading account - for you, it could be a job and your trading account.

At different stages of the market my portfolio varies from my trading accuont, altcoins and NFTS.

I find using a portfolio manager like: https://coinstats.app/ very helpful to see where my portfolio is weighed out, I'll also use the market cycles chart from this course to see when it is time to start taking profits.

One lesson that I learned over a few cycles is there is never a perfect time to take profits, averaging in and averaging out has helped me a tonne.

YES…. There is still an opportunity for all the coins in this portfolio now

Use the strategies from the trading strategy to find good entries on these coins.

Steps To Use Leverage Correctly

- While leverage can amplify gains, it also increases potential losses. Use leverage judiciously, especially if you're a beginner.

Leverage is powerful if you understand how to use it.

But if you don't, you'll lose money as fast as you wish to make it.

- Determine the Leverage Ratio:

- The leverage ratio shows how much more you can trade relative to your actual investment.

- For instance, a 10:1 leverage ratio means you can trade $10 for every $1 of your own capital.

- Calculate the Total Position Size:

- Multiply your own capital by the leverage ratio.

- Total Position Size = Your Capital × Leverage Ratio

- Understand the Implications:

- Higher leverage can amplify profits but also magnifies losses.

- The margin requirement (the amount you need to open a position) will be your capital.

- Calculate Your Total Position Size:

- Your Capital = $1,000

- Leverage Ratio = 10:1

- Total Position Size = $1,000 × 10 = $10,000

- Trading Scenario:

- You open a leveraged position with your $10,000.

- If the market moves in your favor by 5%, the gain is on the total position size.

- Profit = 5% of $10,000 = $500

- Comparison Without Leverage:

- Without leverage, a 5% gain on your $1,000 capital would have been just $50.

- Profit = 5% of $1,000 = $50

- Margin Call: If the market moves against you, you might face a margin call, requiring you to add more funds to keep the position open.

- Risk Management: It’s essential to use stop-loss orders to limit potential losses, especially when trading with leverage.

- Sensible Use: Leverage should be used cautiously, especially for beginners. High leverage can lead to large losses quickly.

Advertising, like trading, is a strategy

But.. when money gets involved it can become hard to follow a startegy. You can spend hours going through YouTube, watching one strategy that has made someone $100 per day.

Then, you try it, It doesn't work…. then what? You wing it…

…fail again!

I've been there and it's not because the YouTube strategy doesn't work. Yes, the dude is probably talking ass but… that's not it.

I'll tell you what it is, you didn't test and optimize the strategy. Like a scientist, you must test the strategy, keep all the variables the same and judge each strategy.

Here is an example:

Say I want to try money flow cross overs on market cipher. Personally, I would use a small amount of money for me… let's say $10,000. Then I test this as a fixed... no variable changes strategy.

MY TRADING STRATEGY

» 2 Months

» Time Frame Money flow cross 1-4 Hour cross overs

» Risk 2% Max

» Risk / Reward ratio 3+

» Cut test - 30% Account Loss

» Confirmations before taking the trade: Looking for money flow cross overs where we have follow crossed taking the trade on the next confirmed candle. Also looking for confirmed support and resistance

This gives me very clear, do's and dont's - of course. I can add just to this strategy alone, maybe it's not the money flow cross over that's the problem.

Maybe:

» I'm front running the trade

» I need to work on making sure I'm marking support and resistance correctly

» I'll continue to refrain and test the strategy along with personal and mental development towards trading

Of course… If you want to trade for fun, or you could just have a strategy to long in the bull run when things go up in crypto everything is the same - you can have a simple strategy or get really detailed with it.

But whatever you do at least have some kind of stragy and your way ahead of most people.

- A trailing stop-loss adjusts the stop price at a fixed percent or dollar amount below the market price, locking in profits as the price rises.

- Different market conditions (volatile, trending, range-bound) require different trading strategies, adapt your approach accordingly.

Questions to ask yourself:

Is the current market bullish or bearish? What's the long month price range high/low?

- Maintain emotional control and avoid impulsive decisions. Stick to your trading plan and avoid overtrading.

Read this

https://www.investopedia.com/articles/trading/02/110502.asp

» Personally - I experience a ton of bias especially when I have trades open I look for other trades on YouTube who are also in a similar trade to gain confidence.

- Stay informed about market trends, news, and developments. Continuous learning helps you adapt to changing market conditions.

Recommended books:

Intelgent investor

Psycology of money

Trading for a living

- Before implementing new strategies, backtest them using historical data. Practice with paper trading (simulated trading) to evaluate their effectiveness without risking real money.

Personally I got started off at college with paper trading but I didn't find it that appealing as like Mike Tyson says: 'Everything changes when you get punched in the face'.

When you trade with real money, it's a completely different ball game.

- It's a science test… You have to be prepared to react to both scenarios.

Always ask yourself, what if I'm wrong?

- If you hold long-term investments, consider using protective puts or other hedging strategies to limit downside risk.

Recently, MYRIA Games launched on BYBIT - which I predicted would happen as we close upon getting to the same market cap as GALA.

Currently, I hold 24 Nodes which would currently cost you over $130k and earns about $13k Per Month worth of MYRIA token paid out daily.

You're telling your parents all about how you always knew you'd be rich and it's time everyone starts taking you more seriously.

You say: "Watch ya bumbaclart mouth rude boy... you're lucky I'm even here…"

You check your wallet to take some money out to throw into another meme coin some guy on YouTube said… Then… What???

30% price impact…

Transaction rejected…

WTH is going on… you jump on Telegram to find everyone acting normal, yet you cant take your profits

LIQUIIDTY….!

What Is Liquidity?

https://www.dextools.io/app/en/pairs

Beam as you can see has over $8M of liquidity which means the buying and selling of a thousand dollars isn't going to give a FTX style red candle.

Let's use $NAKA for example… if your looking for the best liquidity to make a big buy / sell of the token, which exchange would you buy?

1inch Network

1inch Network | Leading high capital efficient DeFi protocols

The 1inch Network unites decentralized protocols whose synergy enables the most lucrative, fastest and protected operations in the DeFi space.

Security Best Practices:

I wouldn't….

That's the same as going around the decentralised crypto world with all your money in one wallet, or trading crypto with all your money on one exchange.

It's just not worth the risk!

Personally, I spread my money across multiple crypto exchanges, hot wallets and cold wallets to ensure I'm safe and also give me quick access to cash to invest.

$2K in my trading account on BYBIT (ADD LINK)

- When you first get started all your eggs might be on one basket on one exchange and that's cool I've been there too, but it's important to have HARD lines you have planned in advance where you know once you have X amount it's time to keep it safe.

Crypto can be used as financial transactions, real estate, technology and more… Meaning regulators have struggled for years to find the correct way to keep it safe and usable.

This means regulations change A LOT.

I use blogs and consult legal advisors like https://silklegal.com/

https://www.investopedia.com/cryptocurrency-regulations-around-the-world-5202122

If I'm not respected by my country, I simply move.

To me freedom is more important than money, and having the ability to do what I want without being told what to do has always been a dream.

Personally, I used an agent here is her number, if you want to learn more just Whatsapp it:

+971 524969203 P.S… Just say '#TY' if you came from this video

- Ask (Offer) Price: The lowest price a seller is willing to accept for a security.

- Bear Market: A market where prices are falling, encouraging selling.

- Bid Price: The highest price a buyer is willing to pay for a security.

- Bull Market: A market where prices are rising, encouraging buying.

- Candlestick Chart: A type of price chart that displays the high, low, opening, and closing prices of a security for a specific period.

- Day Trading: Buying and selling securities within the same trading day.

- Diversification: Spreading investments across various financial instruments to reduce risk.

- Dividend: A portion of a company's earnings distributed to shareholders.

- ETF (Exchange-Traded Fund): A type of security that tracks an index, sector, commodity, or other assets, but can be traded like a stock on an exchange.

- Futures Contract: An agreement to buy or sell an asset at a future date at an agreed-upon price.

- Leverage: Using borrowed capital for an investment, expecting the profits made to be greater than the interest payable.

- Limit Order: An order to buy or sell a security at a specific price or better.

- Liquidity: The ease with which an asset can be converted into cash.

- Long Position: Buying a security with the expectation that its value will increase.

- Margin Trading: The practice of borrowing funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker.

- Market Order: An order to buy or sell a security immediately at the best available current price.

- Options Contract: A contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a certain date.

- Portfolio: A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs).

- Short Selling (Shorting): The practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them ("covering").

- Stop-Loss Order: An order placed with a broker to buy or sell once the stock reaches a certain price, designed to limit an investor's loss on a security position.

- Technical Analysis: A methodology for forecasting the direction of prices through the study of past market data, primarily price and volume.

- Volatility: The degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns.

- Yield: The income return on an investment, such as the interest or dividends received from holding a particular security.

1

A cold wallet is a offline storage such as a hardware wallet which gives you max security

- Go to the Official MetaMask Website: Visit MetaMask.io.

- Download the Extension: Choose the version that corresponds to your browser (Chrome, Firefox, Brave, or Edge) and click 'Download'.

- Add to Browser: Click "Add to [Your Browser]" and confirm the installation.

- Launch MetaMask: After installation, the MetaMask icon (a fox head) should appear in your browser's extension area.

- Open MetaMask: Click on the MetaMask icon.

- Create a Wallet: Choose "Create a Wallet" if you are a new user.

- Agree to Terms: Read and agree to the terms and conditions.

- Create a Strong Password: Enter a strong, unique password.

- Confirm the Password: Re-enter the password for verification.

- Reveal Secret Recovery Phrase: Click to reveal your 12-word secret recovery phrase. This is crucial for recovering your wallet if you forget your password or lose access to your device.

- Write Down the Phrase: Write it down on paper and store it securely. Never share this phrase with anyone and avoid storing it digitally to prevent hacking.

- Verify the Phrase: Confirm your secret recovery phrase by selecting the words in the correct order.

- Complete the Setup: Once verified, your wallet is set up and ready to use.

- View Your Wallet: You can view your account, including your Ethereum address and balance.

- Interact with DApps: MetaMask allows you to interact with decentralized applications (DApps) directly from your browser.

- Send and Receive Crypto: Use your wallet address to receive Ethereum or ERC-20 tokens and send them to others.

- Connect to DApps: Connect to various DApps by authorizing through MetaMask when prompted.

- Security: Always keep your secret recovery phrase private and secure.

- Backups: Consider creating a backup of your secret recovery phrase in another secure location.

- Updates: Regularly update your MetaMask extension for the latest security features and improvements.

- Have multiple wallets per coin so if one gets exposed it's not your main

- There are others out there for different chains they all follow pretty much the same process

2

Purpose and Usage:

- Frequent access and transactions: Hot wallet

- Long-term storage or large sums: Cold wallet

- Evaluate security features like two-factor authentication and backup options.

- Cold wallets generally offer better protection against online threats.

- Consider user interface and simplicity, especially for beginners.

- Ensure the wallet supports the cryptocurrencies you intend to use.

- Look for easy backup and restoration options.

- Research the wallet’s history and user feedback.

- Hot wallets are often free; cold wallets may have a cost.

- Choose wallets with regular updates and support.

- Consider wallets that comply with regional crypto regulations.

- Opt for wallets where you control the private keys.

I recommend adding some ETH to your wallet so you can get started trading on Uniswap.

Remember you always need to have the related token to your chosen chain to trade on in your wallet, if you require a gas fee to trade.

There was a time when my portfolio was unbalanced and some areas of the market were pumping but not the tokens I had. Launchpad tokens would be up 10x, gaming tokens would pump and I would feel like I'm chasing the pump.

There were times where I haven't set stop losses on trades and I've been liquidated, other times where I've made emotionally biased decisions.

I found one of the biggest things that has helped me stay away from those mistakes is having a strategy and a plan before entering.

Knowing where I am in the cycle, and creating scenarios in the market where I'll enter and where I'll take profit.

This is called market cycles.

Now knowing about market cycles and actually executing a plan based on market cycles are two different things.

12:57

YouTube

How Crypto Market Cycles Work beginners Explanation

👉 BITFLEX: Best None KYC Exchange 🌕 https://shorturl.at/coY39 👉 BYBIT ($4.5K DEPOSIT BONUS) 🌖 https://bit.ly/BybitTyrelle 👉 Join the TG channel below https://t.me/thekryptokingofficial My altcoins for 2025 Bullrun https://youtu.be/3nGuzl_fvKA?si=9d05sp1DmP44KlvN Connect with me on socials Instagram: @Thekryptoking_

TradingView

Bitcoin Market Cycles By The Krypto King for BITSTAMP:BTCUSD by tyrellewm

This is my bitcoin market cycle strategy - I am following these 4 Year cycles

1

2

3

The market and your life are one of the same.

- Uniqueness: Each NFT is as unique as your fingerprint or your ability to remember movie quotes. They're digital one-offs.

- Ownership and Provenance: Owning an NFT is like having a deed for a piece of digital land. It's proof that you own a piece of the internet, and you can trace its history back through the blockchain, just like you can trace your family tree, but without the awkward family reunions.

- Interoperability: This fancy word means you can trade NFTs across different platforms. It’s like being able to use your Playstation controller on an Xbox, but don't get your hopes up; that's not happening.

- Royalties: When an NFT is resold, the original creator gets a cut. It's like getting a dollar every time your sibling uses the slang word you invented.

- Digital Scarcity: NFTs bring the concept of rarity to digital items. They're like digital diamonds, rare and sought after, but please don't try to propose with one.

- OpenSea (opensea.io): The Amazon of NFTs, where you can browse an endless aisle of digital goods without getting sore feet.

- Rarible (rarible.com): It's a bit like an art fair where everyone's wearing VR headsets and trading futuristic collectibles.

- Foundation (foundation.app): This is where digital art meets VIP lounge, but without the dress code.

- SuperRare (superrare.com): As the name suggests, it's like finding a four-leaf clover in the digital world. Good luck!

- Nifty Gateway (niftygateway.com): They sell 'Nifties', which sound cute but are serious business in the NFT realm. It's like the boutique shop of the digital world.

Introduction to NFTs

- Definition and Concept:

- NFTs are: unique digital assets verified using blockchain technology, representing ownership or proof of authenticity of a digital or physical asset.

- NFTs can represent, like digital art, collectibles, music, videos, and more.

- How NFTs Work:

- Overview of blockchain technology and its role in ensuring the uniqueness and ownership of NFTs.

- Explain smart contracts and how they govern the terms of ownership and transferability of NFTs.

- Marketplaces:

- Introduce popular NFT marketplaces (e.g., OpenSea, Rarible, Foundation, SuperRare).

- Discuss the differences between them, such as fees, types of NFTs, and blockchain compatibility.

OpenSea

OpenSea, the largest NFT marketplace

OpenSea is the world's first and largest web3 marketplace for NFTs and crypto collectibles. Browse, create, buy, sell, and auction NFTs using OpenSea today.

- Creating and Minting NFTs:

- Step-by-step guide on how to create and mint an NFT, including choosing a platform and understanding gas fees.

This is where the MONEYYYY is made in the NFT market.

Minting NFTs and listing them is the reason we see such volume enter the NFT market.

Imagine you buy a NFT for 0.1 ETH and instantly on market it's 5ETH.

This happened to me with Sneaky Vampires... Yes, it's dead now.

But I made a lot of money from these NFTS:

CoinGecko

Sneaky Vampire Syndicate NFT Floor Price Chart | CoinGecko

Browse Sneaky Vampire Syndicate NFT price floor, chart, trading volume, rarity traits, and more.

- How I Buy NFTs:

- Choose a Wallet: OpenSea supports several digital wallets, like MetaMask, Coinbase Wallet, and others. MetaMask is a popular choice.

- Install the Wallet: For MetaMask, you can install it as a browser extension on browsers like Chrome, Firefox, or Brave.

- Create Your Wallet: Follow the instructions to create a new wallet. Remember to securely store your recovery phrase.

- Purchase Cryptocurrency: Most NFTs on OpenSea are bought using Ethereum (ETH). You can buy ETH through your wallet or a cryptocurrency exchange, then transfer it to your wallet.

- Transfer to Wallet: If you bought ETH on an exchange, transfer it to your digital wallet address.

- Visit OpenSea: Go to the OpenSea website.

- Connect Wallet: Click on the wallet icon in the top right corner of OpenSea and select your wallet type (e.g., MetaMask). Follow the prompts to connect.

- Explore Collections: Browse through the various NFT collections and find one that you’re interested in.

- Select an NFT: Click on an NFT to view its details, including price, history, and properties.

- Buy Now or Make an Offer: If the NFT is available for a fixed price, you can click "Buy Now" and proceed with the purchase. Alternatively, you can make an offer.

- Confirm Transaction: Your wallet will prompt you to confirm the transaction, including any associated gas fees (transaction fees on the Ethereum network).

- Complete the Purchase: Once you confirm and the transaction is processed, the NFT will be transferred to your wallet.

- View in Wallet: Your purchased NFT will be visible in your OpenSea profile and in your connected wallet under the collectibles section.

- Gas Fees: Be aware of gas fees (transaction fees), which can vary based on network congestion.

- Security: Always be cautious of scams and only buy from reputable sources. Never share your private keys or recovery phrase.

- Research: Do some research on the NFTs you're interested in to understand their value and authenticity.

- My stupidly simple strategy

Go to Google Trends

Then, my friend you are a bag holder… whatever you thought this thing was worth it no longer is.

defillama.com

NFT Collection - DefiLlama

Dashboards

But just a few weeks later… we see a HUGE decline in value and now you can buy the same NFTS for 0.04ETH

- Portfolio Diversification:

- Just like altcoins, private sales and trading - we diversify with gaming, L1, L2, Di-Fi, etc. (If you don't know what that is skip to the part of the course and learn.)

OPENSEA - https://opensea.io/

COINMARKETCAP - https://coinmarketcap.com/

COINGEKKO - https://www.coingecko.com/

So, here is the source I recommend for crypto legal advice.

Seriously… Most people have questions about tax and they want a fast, reliable response.

This is the best company to reach out to.

Well, my friend…

You got in this game because you wanted to make a lot of money, right?

To become the $100M version of yourself you must be that person before the money.

1. Never short the bull market

2. Stack Bitcoin… Seriously think about it imagine if you actually couldn't afford 1 BTC forever

3. Don't marry your bags, remember the cycles

Finally, I recommend looking up the laws of frequency, vibration, remember getting stressed out, emotional and jealous of other people can lead to you losing gains. What you put out is what you get back.

So put out positive energy and help in Telegram chats, join the community below and good luck on your journey!

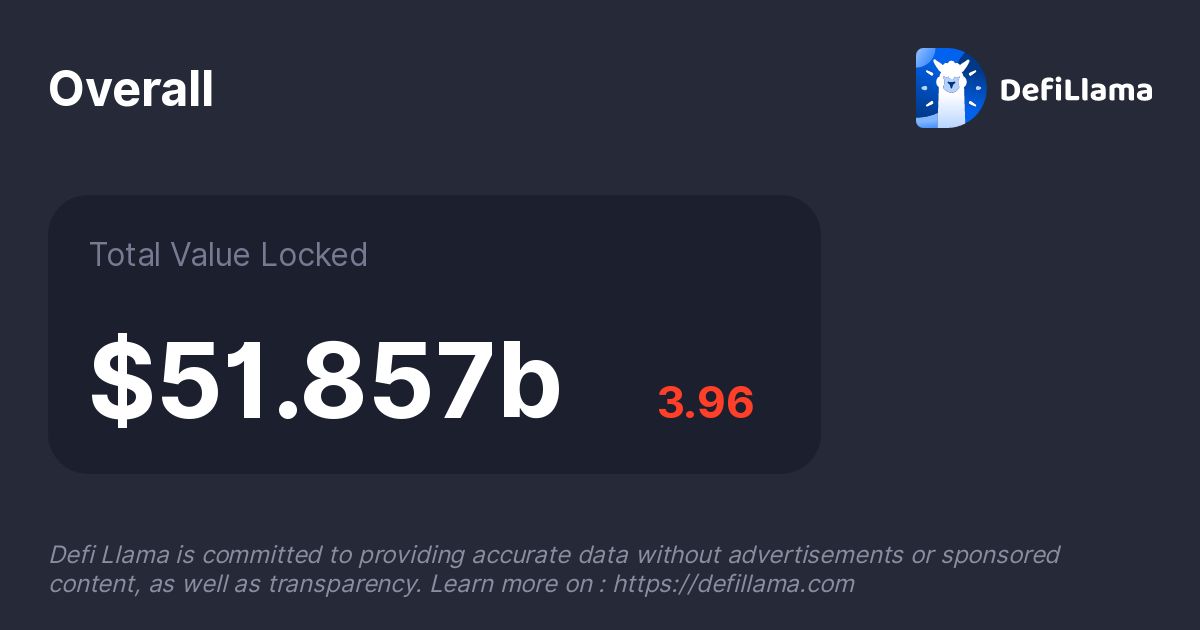

DefiLlama

DefiLlama

DefiLlama is a DeFi TVL aggregator. It is committed to providing accurate data without ads or sponsored content, as well as transparency.

CryptoRank

List of Upcoming IDO IEO and ICOs | CryptoRank.io

List of upcoming token generation events and token sales. Information about the date of the event, initial capitalization, total raise.

What are private sales?

- Exclusive Access: Typically, only a limited number of accredited or institutional investors are invited.

- Lower Price: Tokens are usually offered at a lower price compared to future public sales.

- Higher Risk and Reward: Investors in private sales often face higher risks due to the project's early stage, but they also have the potential for higher rewards if the project succeeds.

- Example: Imagine a new blockchain project offering its tokens to a group of venture capitalists and blockchain investment firms before the tokens are available to the general public.

- Open to Public: Unlike private sales, ICOs are typically open to the general public.

- Early Investment Opportunity: Investors get a chance to buy tokens early in the hope that the project will be successful and the token value will increase.

- Similar to IPOs: ICOs are akin to IPOs (Initial Public Offerings) in the stock market but are unregulated and come with higher risk.

- Example: Ethereum's ICO in 2014 is a famous example, where early investors purchased Ether (ETH) tokens, which later became one of the most valuable cryptocurrencies.

So far this cycle has played out, personally for the lowest price, Bitcoin is on track for the mid cap cycle. Next, I'm looking at smaller market caps and taking profits in 2025.

During this time, I will always take initial if I'm up more then 2x on a investment.

TradingView

Bitcoin Market Cycles By The Krypto King for BITSTAMP:BTCUSD by tyrellewm

This is my bitcoin market cycle strategy - I am following these 4 Year cycles

One of the biggest lessons i've learned is its not cash that is king.. It's cashflow.

Think this, let's say someone is in a full time job while investing into crypto; starting with a $5k portfolio they manage to flip it to $20k.

I have also spent money on courses and mentorship that has helped me learn more about sales, marketing and online business.

SUMMARY

2025 exiting the market moving into cashflow assets until then, cycling the profits.

RISK: This could all go wrong, I could be wrong… which is why high income skills are very important if investments fail.

This is why a portfolio becomes very important personally, I put a very small amount of my net worth into private sales and I have high income skills and cashflow businesses as a procession incase crypto goes wrong.

- Token Sale: The event of selling the project's tokens to investors.

- Whitepaper: A detailed document outlining the project’s concept, technology, and roadmap.

- Smart Contract: The blockchain-based contract used to manage the ICO’s token sale and distribution.

- Ethereum: A popular blockchain platform for launching ICOs.

- Public Offering: ICOs are open to the general public for investment.

- Crowdfunding: ICOs are often seen as a form of crowdfunding for blockchain projects.

- Roadmap: A timeline of the project’s development and future plans.

- Pre-ICO: An early stage of the ICO, often with special terms or discounts.

- Regulation: Legal considerations and compliance issues surrounding ICOs.

- Tokenomics: The economic model and utility of the project’s tokens.

- Valuation: The assessment of the project’s worth, usually determined by investors and the market, based on the potential and feasibility of the project.

- Accredited Investors: Individuals or entities allowed to participate in private sales.

- Early Access: Privileged access to invest in the project before it goes public.

- Discounted Price: Tokens are often offered at a lower price in private sales.

- Limited Allocation: A restricted amount of tokens available for sale.

- Venture Capitalists: Common participants in private sales.

- Strategic Partnerships: Collaborations with key stakeholders or companies during the private sale phase.

- Confidentiality: Details of the private sale might be confidential or under NDA.

- Seed Round: An early investment round, often synonymous with private sales.

- Cap Table: A document or record showing the equity ownership in the company.

- Due Diligence: The process of vetting and evaluating the project before investing.

CryptoRank

Sidus Heroes

Discover fundraising information: %crowdsale_type% %funding_rounds% return on investment (ROI), prices of investors, and funds raised by %name% %code%. Review the white paper, team, and financial overview.

Private Round: 4.7x

ICO: 2.8x

- Launchpads

Thank you for your time - your next step below.